The Falling Canadian Dollar: Is OPEC to Blame?

Photo credit: Dru Oja Jay, Flickr Creative Commons. http://tinyurl.com/k5axhv3

Photo credit: Dru Oja Jay, Flickr Creative Commons. http://tinyurl.com/k5axhv3

Determining whether Canada’s falling exchange rate is a result of the Organization of the Petroleum Exporting Countries’ (OPEC) persistent output despite falling oil prices may seem an unnecessary case of playing the blame game. However, understanding OPEC’s impact on Canada’s exchange rate and the national economy as a whole is vital if such events are to be prevented, or at least prepared for, in the future.

OPEC is the most successful and functional case of a cartel, according to cartel theory. Robert Pindyck, Professor of Finance and Economics at MIT, wrote on oil cartel profitability in 1978, and his findings remain relevant today. Pindyck (1978) explains that in the oil market, cartelization enables 50% to 100% higher profits, compared to a competitive scenario where price is equal to marginal cost of production. Cartels coordinate members to act as a monopoly, with additional supply from non-cartel members referred to as the competitive fringe. By controlling a significant share of the market, cartels exert market power over the competitive fringe producers, charging monopoly rents and earning higher profits.

Until recently, OPEC’s policy had been to supply quotas of oil at prices above the marginal cost of production, in order to afford members higher profits. At these high prices, oil reserves previously considered uneconomical, such as the tar sands, become viable to exploit, increasing the non-OPEC supply of oil. This can be observed in OPEC’s falling market share: in 1973 OPEC’s share of world total was 53% but holds a market share of about 40% today (Watkins, 2006).

The profitability of a cartel relies on many factors, including the quantity of supply from competitive fringe and price dependence on substitutes and alternatives. The tar sands fall into Pindyck’s competitive fringe category, and shale oil could be considered a competitive alternative to OPEC supplied oil in the US. Thus, as production of shale oil and tar sands oil increased, OPEC may have felt threatened due to their decreasing overall market share. As cartel members wish to continue earning high profits, maintaining their market share is essential. A possible strategy is to cut prices, initiating a price war. Cartel members with lower production costs than the competitive fringe, such as Saudi Arabia, will be able to lower prices to levels which make oil with higher production costs, such as the tar sands, unprofitable to continue extracting.

While a lower oil price means lower profits for OPEC members, it enables members to retain a sufficient market share to exert control over the market and lower prices often lead to increased demand. OPEC’s February 2015 forecasts estimate that low prices will cut growth in non-OPEC oil supply. The forecast considers impacts on the Canadian economy as a result of recent declines in energy prices. Industrial production growth data fell to 2.3% year-on-year in November 2014 from 3.1% year-on-year in October. Mining, oil and gas extraction also decreased to 4.2% in November from 5% in October. Overall, Canada’s forecast GDP growth for 2015 has been revised to 2.3% from 2.4% in January.

If OPEC has initiated a price war and price of oil continues its downward spiral, how hard will Canada be hit? If OPEC wishes to maintain their market power, low prices can be expected in order to push the competitive fringe suppliers out of the market. If OPEC no longer holds significant market power, prices will also fall as competitive prices are set at the marginal cost of production, as is dictated by economic theory (Pindyck, 1978). With or without OPEC, oil-dependent countries with high extraction costs can expect to be hit hard.

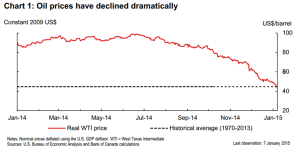

In a recent speech the Deputy Governor of the Bank of Canada, Timothy Lane, estimated that 3% of Canadian GDP depends on oil extraction, and crude oil now makes up 14% of total Canadian exports, with almost all of that oil being exported to the US. Lane explains how, at prices of $100 per barrel, supply of oil dramatically increases, citing a fivefold increase in Canadian oil sands production between 1993 and 2014, and the shale revolution underway in the US. Extracting oil from the oil sands costs from $60 to $100 per barrel, and shale oil costs between $40 and $80. While technology may reduce these high costs over time, if oil prices continue to fall it is clear that first the oil sands, and then shale oil, will no longer become profitable to extract, and investment and exploration will decrease.

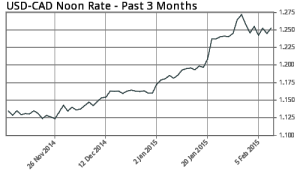

With falling oil prices, currencies of oil-dependent economies also fall, including the Canadian dollar, Norway’s krone and the Russian ruble. Canada’s economic dependence on the oil sands coupled with falling levels of production and investment in the oil sands mean that further falls in the value of the Canadian dollar may be in store. However, while oil prices began to fall in November, the value of the Canadian dollar fell to considerable lows at the end of January and early February 2015 (See figure 2, on USD-CAD exchange rates over the past three months). Changes by production and refining firms take time, and reaction times for the oil industry are much slower than other exports, for example, food (Pindyck, 1978). Falling oil prices in late November and December are now impacting the Canadian dollar.

A national economic strategy is needed to offset the falling profitability of this key natural resource. According to Shawn McCarthy and Eric Reguly, correspondents for the Globe and Mail, “future projects sidelined or scaled back will act as a drag on the national economy, which has for years benefited from heavy spending in the energy sector while other sectors such as manufacturing struggled”.

While Canada may or may not be suffering from Dutch Disease, which occurs when natural resource discoveries draw national investment away from other sectors such as manufacturing, the case remains that falling oil prices are making much of Canadian oil unprofitable to extract. To counter the inevitable fall in economic growth, alternative industries must be developed.

Given the frequency of unpredictable oil price shocks due to geopolitical reasons and the behaviour of OPEC, a possible solution would be to shift investment within Canada away from potentially uneconomical natural resources such as the tar sands or shale oil. More stable and predictable industries should be relied upon, while ensuring that national energy security will also be maintained. There is a solution to this dilemma: renewable energy sources.

Investing in renewable energy could ensure Canada’s energy needs are met, while avoiding the geopolitical and OPEC induced external shocks that affect any economy dependent on oil extraction. A Clean Energy Canada report claimed that clean energy directly employed more people than the oil sands by the end of 2012, when data was last compiled: 23,700 people in clean energy while 22,340 were employed in the oil sands. Wind, solar, run-of-river, and biomass energy has grown by 93% since 2009, and if such high growth continues, this would be a profitable and environmentally-friendly alternative to national economic dependence on oil. However, so far only one of the top five investors in Canadian green energy is a Canadian company: the others are from Germany and Japan.

Canada’s dependence on oil makes economic growth and the exchange rate extremely susceptible to external shocks. This vulnerability can be feasibly and profitably reduced, however it requires a shift in government policy away from oil extraction in Alberta towards investment in green energy projects across Canada.

______________________________

Bibliography

Pindyck, Robert S. “Gains to producers from the cartelization of exhaustible resources.” The Review of Economics and Statistics (1978): 238-251.

Watkins, G. Campbell. “Oil scarcity: What have the past three decades revealed?.” Energy policy 34.5 (2006): 508-514.