Will Venezuela Bite on Bitcoin?

According to the United States Federal Reserve, the ideal inflation rate in a given year is 2%. However, in Venezuela, they may have just missed that mark, with a current inflation rate of 720%. For Venezuelans, it costs about $30,000 bolívares for a meagre meal. To put this into perspective, for a simple hamburger, most Venezuelans would have to visit at least 4 ATMs to accumulate appropriate amount of cash, carry this overwhelming amount in at least a full duffle bator suitcase, and even then, they would most likely be spending a significant portion of their monthly paycheque. Additionally, this isn’t even factoring in food shortages (you most likely won’t be finding the ingredients for a full hamburger in Caracas right now). Economically, it is looking grim in what used to be Latin America’s wealthiest nation.

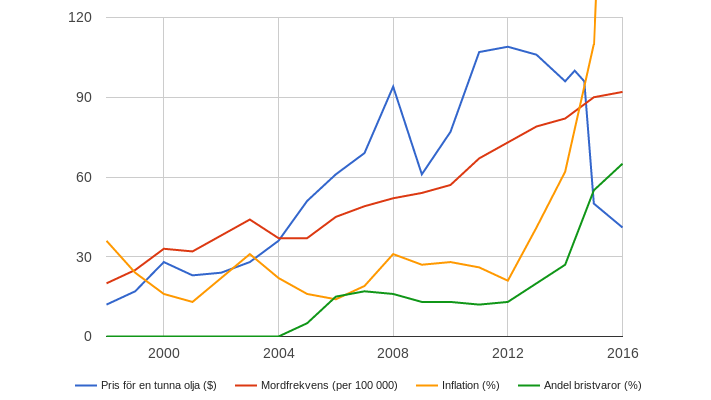

As history attests through examples such as the Weimar Republic and Zimbabwe, hyperinflation isn’t easy to combat. For Venezuela, there are layers upon layers of issues. Primarily, the hyperinflation is being caused by Venezuela’s falling export revenue, a byproduct of President Nicolás Maduro’s hard stance on procuring capital from multinational sources. This hard stance has driven down the number of global firms willing to work with Maduro, leading to oil-producing stagnation and rising prices in the petrostate. Similarly, the prominence of the Venezuelan black market, the collectivization of farm land by Hugo Chavez, and the artificial scarcity prevalent in consumer markets, all have added to the mess that is the Venezuelan bolívar.

One possible solution to this hyperinflation, for many Venezuelans, is to start mining Bitcoins. Bitcoin, a global cryptocurrency invented in 2009, operates devoid of any government institutions. Cited as a growing currency, paired with skyrocketing market value, Bitcoin’s success could be a saviour to Venezuelans, who have continued to plummet into economic crisis when their subsequent lack of tangible cash was met with the removal of their $100 note by Maduro. But how?

To start, Bitcoin is easily accessible to the majority of Venezuelans, as all that is required is some electricity, a phone, and a wallet app. With relatively easy access to phones, and subsidized electricity from the communist state, the final key here is the lack of a bank account needed. Currently, a large portion of Venezuelans don’t have access to formal banking, made hard to maintain by hyperinflation, so the necessity of a Venezuelan bank-free currency is integral given the limited cash available. Bitcoin not only is easily accessible, but it is also preferred by many businesses, many of whom are trending towards only accepting the cryptocurrency, wary of the instability a bolívar holds. In addition, the currency has allowed many Venezuelans to purchase goods they need online, through websites such as Amazon.com, an ability not afforded to them with the bolívar.

However, not everything is going well in the world of Bitcoin. Bitcoin usage is currently limited to a minuscule 1% of the population, a growing yet tiny proportion. In addition, President Maduro, a staunch anti-capitalist, has pointed to the “capitalist mechanisms” of cryptocurrency as one of the primary causes of the failing economy, and has taken effective police action against mine operators across the nation. One Venezuelan entrepreneur, John Villar, responded to this crackdown by stating that, “Bitcoin is a way of rebelling against the system.” Faced with a system where a box of pasta would be the USD equivalent of $301.50, or where the black market is a more trustworthy infrastructure than the government itself, one thing is clear: rebellion is a necessity.

Edited by Benjamin Aloi