Trump vs Harris: Tariffs and Foreign Trade

By: Adele Torrington

Copyright 2008 by Peter J Markham

Copyright 2008 by Peter J Markham

This content has been archived. It may no longer be relevant

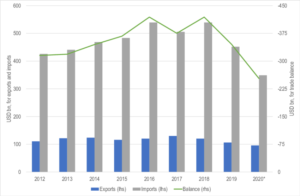

When former US President Donald Trump took office in 2016, he promised to reduce the US trade deficit. He aimed to enforce protectionist policies and renegotiate foreign trade agreements to favour American industries. He criticized companies like Ford Motors and Carrier Corporation for sourcing materials and manufacturing overseas, particularly in Mexico and China. He vowed to bring jobs back to the US by altering trade agreements and imposing heavy tariffs on foreign competitors. On November 21, 2016, after taking office, Trump introduced his “America First” policy, arguing that multilateral agreements were detrimental to the US economy, and withdrew from the Trans-Pacific Partnership (TPP), an Obama-era agreement designed to strengthen trade ties with Asia and counter China’s growing influence.

In 2018, Trump launched a trade war with China, imposing tariffs on approximately $360 billion USD worth of Chinese goods, with duties ranging from 30 to 50 per cent on products like steel, aluminum, solar panels, and washing machines. China retaliated by imposing tariffs on US exports, sparking a trade conflict that disrupted global supply chains. Shortly after, Trump expanded tariffs to include Mexico, Canada, and the European Union, leading these countries to impose retaliatory tariffs on US goods. This tariff escalation prompted the renegotiation of the North American Free Trade Agreement (NAFTA), which was replaced by the United States-Mexico-Canada Agreement (USMCA). The rapid rise in prices due to these tariffs hurt American industries, particularly farmers, many of whom were financially strained due to heightened machinery prices. In response, the Trump administration provided billions in aid to farmers through the Commodity Credit Corporation, a Great Depression-era program designed to support struggling agricultural workers.

Toward the end of his presidency, Trump lifted many tariffs on Canada and Mexico due to new agreements in the USMCA. However, in 2019, he imposed an additional 15-per cent tariff on Mexican imports in an effort to curb illegal immigration, a move that threatened the USMCA. Studies showed that Trump’s tariff policies adversely affected the U.S economy, reducing GDP and decreasing real income, effectively marking one of the largest tax increases in American history. Before he left office, however, Trump came to a truce with China called Phase One, in which China agreed to purchase nearly $200 billion USD of US goods.

When the Biden administration entered office in 2021, they took a different approach to trade, focusing on rebuilding alliances and rejoining multilateral agreements. In late 2021, the administration negotiated with the European Union to settle disputes over steel and aluminum tariffs. However, the administration surprised many by continuing some of Trump’s tariffs on Chinese goods as China failed to meet its promises from Trump’s Phase One deal. In fact, Biden increased tariffs on certain Chinese exports, including semiconductors and other technological products, citing China’s unfair trade practices. American tariffs on Chinese semiconductors also aim to impede China’s ability to develop AI that could benefit its military. Biden also introduced the Inflation Reduction Act and CHIPS Act to boost domestic production of semiconductors and clean energy technologies, seeking to move key manufacturing operations away from China and back to the US. Many of Biden’s policies are expected to curb prices and inflation, but that will take time, meaning much of their success will depend on the policies of the next administration.

Trump has announced that, if reelected, he will impose a sweeping 10- to 20-per cent tariff on all US imports and an additional 60-per cent tariff on Chinese goods. While Chinese products are known to flood US markets, the longterm impact of these tariffs could result in further tax hikes and price increases. He has claimed they “won’t be a cost to consumers” but rather be the burden of other countries. However, economists generally find these claims misleading. When Trump placed 12-per cent tariffs on washing machines in 2018, US consumers paid $1.5 billion USD more than they would have. With the new proposed tariffs, studies suggest the average US household would lose $1,700 USD with the new proposed tariffs.

If Vice President Kamala Harris were to assume the presidency, her approach to trade and tariffs would likely align with Biden’s policies. Although Harris has laid out detailed economic plans, including proposals for child tax credits, middle-class support, and lowering grocery prices, she has not outlined a specific trade policy. However, she is expected to continue to prioritize reducing offshoring, promoting green energy, and confronting Chinese trade practices. Harris would likely maintain many of the existing tariffs on Chinese imports, continuing some Trump-era tariffs and the current administration’s efforts to protect US industries and strengthen domestic production.

Both candidates aim to address the growing US trade deficit, which is the imbalance between consumption and production of American goods. While the idea of a more self-sufficient economy appeals to many voters, the reality that reduced dependence on foreign production will result in higher domestic prices is often overlooked. Higher tariffs, as seen during Trump’s first term, would likely lower GDP and could trigger widespread discontent. Yet, most Americans are sceptical of the benefits of trade with other nations. Although trade is not a top concern for most Americans, it has become an issue in the 2024 election, the outcome of which will have profound economic consequences globally.

Edited by Lily Molesky

Featured Image: “APL China in San Francisco” by Pete Markham is licensed under CC BY-SA 2.0.