The Corporate Raid on the United States

Trans World Airlines used to have flights running around the world. https://flic.kr/p/nrgH8s

Trans World Airlines used to have flights running around the world. https://flic.kr/p/nrgH8s

Fifty years ago, Trans World Airlines (TWA) was a household name. Founded in 1924, the airline grew in the postwar era to serve Europe, the Middle East, and Asia. It was the second flag carrier of the United States, after Pan Am. Today, however, the airline is largely known only as an example of the dangers and power of corporate raiding.

By 1984, the airline fell into trouble. Jimmy Carter signed the Airline Deregulation Act, which sent the industry into a dizzying spiral of competition. Airlines struggled to solve a problem fundamental to the industry: with the immense overhead required, how do you compete and effectively manage those fixed costs? Airlines struggled to cut prices enough to remain competitive, making margins razor thin and leaving no room for error.

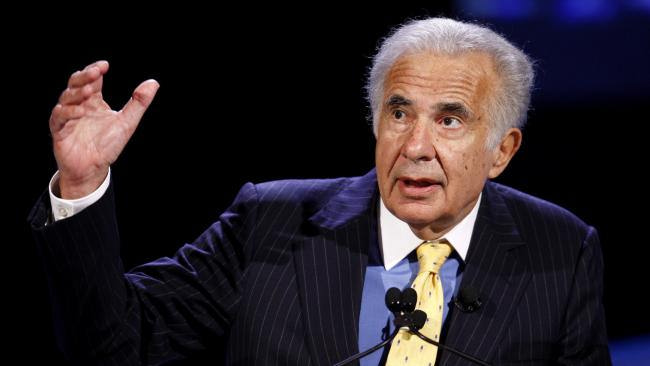

The company’s struggles set the stage for Carl Icahn. Icahn aggressively purchased stock in TWA, eventually taking control in 1988. Icahn initially promised his goal for the company was to make it profitable, but it soon became apparent that this was not the case. Instead, Icahn was interested in using the company and its assets to line his own pockets; the well-being of the company and its employees was not his concern.

Icahn proceeded to sell company assets to repay the money he owed from his takeover. This process, known as “asset stripping”, was a relatively common practice in the 1980s. Icahn’s strategy was simple, but effective: raise money for a takeover of the company, and once in control, sell company assets to repay that money with margin to spare. While effective and incredibly profitable for Icahn, this would prove to be the first step towards bankruptcy for TWA. Without its key revenue-producing assets, the company would no longer be able to finance its debts and turn a profit. In 1992, TWA filed for bankruptcy. While this wasn’t the death knell of TWA, it was the beginning of the end.

Icahn, meanwhile, would walk away with $469 million from TWA’s privatisation alone.

The 2017 Tax Reform

In the final days of 2017, the U.S. Congress passed the largest tax reform bill in 30 years. The effects of this bill are–and will be–wide ranging. Although some aspects of the bill are indeed controversial, two of its key products are relatively undisputed. First, the benefits of the tax reform are skewed towards the wealthiest Americans. The Tax Policy Center, a non-partisan think tank based in Washington D.C., reported that while middle class households may enjoy a $900 tax cut on average, the top 1% would pocket an additional $50,000 per year. Second, U.S. debt will expand drastically in order to pay for a tax cut that wasn’t matched with a reduction in spending.

The tax plan holds a clear bias to the wealthiest Americans. Trump reportedly told friends at his Mar-a-Lago resort on Friday that they “all just got a lot richer”. The Tax Policy Centre reported that over time, the benefits would skew even more favourably to the wealthy, with, by 2025, 65.8% of the savings going to the top quintile of earners.

Meanwhile, the Congressional Joint Committee on Taxation reported that the deficit would balloon by nearly an additional 1.5 trillion dollars over the coming decade. In effect, the Tax Bill is an enormous dividend to the wealthiest Americans, financed by an enormous increase in public debt.

The 2017 Asset Stripping of America

Asset stripping is a pretty simple strategy: gain control of assets, sell them off to finance personal profit (like dividends for investors), and then leave the company (or country) to deal with its debts without the benefits of the revenue those assets produce.

In the case of the Tax Reform, Congress auctioned off $1.633 trillion in income to finance the governmental equivalent of a dividend: tax cuts. With over 65% of those savings going towards the richest Americans, it represents one of the greatest upwards wealth transfers in modern history.

The costs of such a transfer are not insignificant. The Congressional Budget Office (CBO), the bipartisan agency responsible for evaluating the impact of laws before they are passed, reported that by 2027, an additional 13 million people will no longer have health insurance. Additionally, insurance premiums for those in non-group pools would increase by 10%. And the additional $1.5 trillion that the federal government will borrow must be financed as well, leading to significant draws on a budget that must meet many demands.

In effect, Congress is selling-off the future product of the nation in order to pay for dividends to the wealthiest Americans.

A TWA Future

The United States is therefore left in a position not unlike TWA forty years ago. It has nearly the same burdens as before, but must deal with them without a significant source of income that is now being sent to the U.S. government’s equivalent of a shareholder: the wealthy. Like TWA, it must take on more debt to keep its operations running.

Therein lies the problem with the U.S. tax plan. The U.S. government is taking on enormous debts–and the long-term costs associated with them–in order to finance payments to the Americans who need it least. The tax plan is asset stripping, but of the nation as a whole. If the US wants a white picket fence and apple pie for all its people, and not just those on top, it can’t do it by selling off the nation to the rich. It needs to invest in its greatest assets– its people–in order to build the American Dream.

Edited by Kathryn Schmidt