Rethinking Equalization

Parliament of Canada, Courtesy of joiseyshowaa at Flickr Creative Commons

Parliament of Canada, Courtesy of joiseyshowaa at Flickr Creative Commons

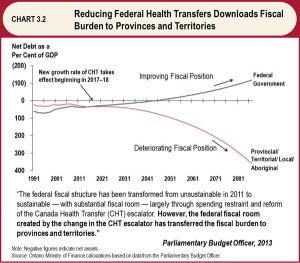

Canada’s total government debt (including both federal and provincial) stands at roughly $1.2 trillion, and over $500 billion of the debt is born by the provinces [1]. Although the federal government’s portion of total debt is still higher, this will soon change. According to Jean-Denis Frechette, who is the Parliamentary Budget Officer, the federal government can potentially eliminate all of its debt by 2044 [2]. However, provincial debt will continue to grow, as visible on the chart produced by Ontario’s Ministry of Finance. One of the major reasons for such disparity is because of the federal government’s cuts to its health-related transfers to provinces. Due to an aging population, Canada needs an average of 4.9% annual increase in health spending until 2050 [2]. However, since 2006, the federal government has reduced the annual growth rate of Canada Health Transfer that it sends to the provinces every year, resulting in placing $25 billion fiscal burden on provincial governments between 2017 to 2024 [3]. In addition, the federal government has cut or reduced other health-related contributions to RCMP Health Care, Interim Federal Health Plan, as well as health care services provided to immigrants [3]. To illustrate the situation in detail, take a look at Ontario. In 2014-2015, federal transfers to Ontario decreased by $641 million from the year before. In addition, federal government either did not renew or terminated funding programs, cutting $1.7 billion over next three years in Ontario from areas including health, retirees, police, and childcare [4].

Given such information, it is difficult to believe the federal government’s claim that it is exercising excellent fiscal restraint. In part, it is much more fiscally conservative than former governments. However, a large part of its deficit reductions are being supported by provinces, who have to take on more health related spending due to the federal government’s cuts. Whether the deficit ends up on the federal or the provincial government’s balance sheets, Canadian taxpayers are ultimately the ones responsible for it. A more problematic fact is that the federal government is using its projected budget surplus to reduce taxes in a populist move – specifically for Canada’s top income earners with the newly introduced income-splitting tax cuts. Meanwhile, provincial governments are either cutting health services or taking on more debt to provide quality medical service to Canadians (or struggling to at least maintain its mediocre medical service). With provinces such as Ontario and Quebec struggling to maintain their fiscal position (as usual), and with normally rich provinces like Alberta and B.C. suffering from low commodity prices, it is a difficult time for all provinces. In fact, it currently is not among the provinces that there exist great inequalities. A greater inequality exists between the provinces and the federal government.

There are several ways to tackle this problem. First would be making it impossible for the federal government to download costs onto the provinces, perhaps through a constitutional amendment, which of course would be very difficult to achieve. Another option is through greater taxation at the provincial level; this is already materializing with increases in income and/or corporate taxes in B.C., Quebec, and others [2]. The third option is to reform the existing equalization program to include the federal government. To provide more background information, the equalization program was introduced after the Great Depression in order to ensure that provinces have comparable levels of public service. In other words, the federal government takes funds from each province to create a pool of funds, does complex calculations to see how each province is faring, and then redistributes the fund back to the provinces. Relatively poor provinces, such as the Atlantic provinces or Quebec are the beneficiaries, whereas richer provinces such as Alberta or British Columbia contribute to the well-being of their fellow provinces. My proposal is to keep the current system, where funds are transferred from well-off provinces to badly-shaped provinces, but also include the federal government in the equalization program too. When the federal government is well-off, it transfers equalization payments to provinces with poor fiscal health in comparison to the federal government, and vice-versa.

The reasons I advocate this method are as follows. For one, this fixes the problem of downloading costs onto provinces; now, when the federal government hands over more fiscal burden to the provinces, the federal government ultimately needs to pay for it with higher equalization payments to the poor provinces. Second, this does not require a constitutional amendment, since it is an adjustment that does not impact the Constitution that “Parliament and the government of Canada are committed to the principle of making equalization payments to ensure that provincial governments have sufficient revenues to provide reasonably comparable levels of public services at reasonably comparable levels of taxation.” (Subsection 36(2) of the Constitution Act, 1982) [5]. Third, this ensures that the provinces do not become overly powerful. Following the current model, the federal government will decrease in its fiscal size in comparison to the provinces. In other words, the federal government will become smaller, and provide less public service while decreasing taxes as well. Instead, provincial governments will provide more public service and collect more taxes to pay for it. If the provinces continue to take on more fiscal burden and a greater share of the tax revenue, provinces will eventually demand more rights and power from the federal government. Already, Canada has strong provincial governments with a fairly large degree of self-control. For national unity’s sake, there is no need for more powerful and autonomous provincial governments.

Of course, there are some problems with this idea. For one, it creates a governmental moral hazard. Provinces will feel assured that even if their finances deteriorate, the federal government’s transfers will partially make up for it. The opposite is true also; the federal government may be induced to give away even more tax cuts and create a deficit, with the knowledge that it will receive funds from the provinces. Secondly, it will be extremely difficult to have the federal government agree to this arrangement. Mr. Harper (and many future Prime Ministers) will be much happier using the budget surplus to buy more votes. To resolve the first problem, a rule can exist that caps the maximum equalization flow that can exist between the federal and the provincial governments (such a cap already exists in between provinces). This cap will be increased according to inflation, to make sure that the value of equalization transfers does not erode over time. Such a cap will make it clear to all governments that the amount of money they can get is limited, both in size and in growth every year. In a hypothetical example, Ontario could get at most $5 billion per year from the federal government, and the increase of the cap would be indexed to inflation (please note that the $5 billion is an arbitrary number I created for the example).

To resolve the second problem, provinces must adamantly push the federal government to agree to this reform. They need to continue to publicly criticize the federal government’s downloading of the costs, even more vocally than they are now. External conditions, such as a rating agency’s downgrade of some provinces, or the existing fall in oil revenue, will provide an excellent opportunity for provinces to convince the voters that provinces are in dire need of more transfers from the federal government. In other words, this change will not materialize unless voters actively demand it in both the provincial and federal elections. As provincial debt burden continues to grow, the public will become more aware of potential provincial bankruptcies and demand resolution. Maybe only then will this idea be in the spotlight.

_____________________________

Works Cited:

[3] http://www.canadaspremiers.ca/en/latest-news/74-2014/404-communique?showall=1&limitstart=

[4] http://www.fin.gov.on.ca/en/budget/ontariobudgets/2014/ch3.html